tax shield formula excel

The effect of a tax shield can be determined using a formula. This is usually the deduction multiplied by the tax rate.

Resolution Of Tax Shield On Interest Expense In Wacc Edward Bodmer Project And Corporate Finance

Solvency ratio is one of the quantitative measures used in finance for judging the company financial health over a long period of time.

. A company carries a debt balance of 8000000 with a 10 cost of debt and a 35 tax rate. Depreciation Tax Shield is the tax saved resulting from the deduction of depreciation expense from the taxable income and can be calculated by multiplying the tax rate with the depreciation expense. Interest Tax Shield Example.

Tax Shield Deduction x Tax Rate. Companies using accelerated depreciation methods higher depreciation in initial years are able to save more taxes due to higher value of tax shield. To learn more launch our free accounting and finance courses.

Solvency Ratio 32500 5000 54500 43000 Solvency Ratio 38 Explanation of Solvency Ratio Formula.

Tax Shield Formula How To Calculate Tax Shield With Example

Tax Shield Definition Formula Example Calculation Youtube

Depreciation Tax Shield Formula And Excel Calculator

Tax Shield Formula Step By Step Calculation With Examples

Tax Shield Formula How To Calculate Tax Shield With Example

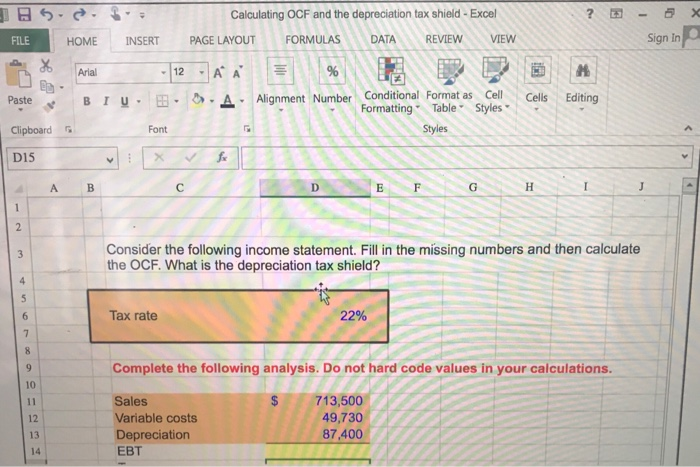

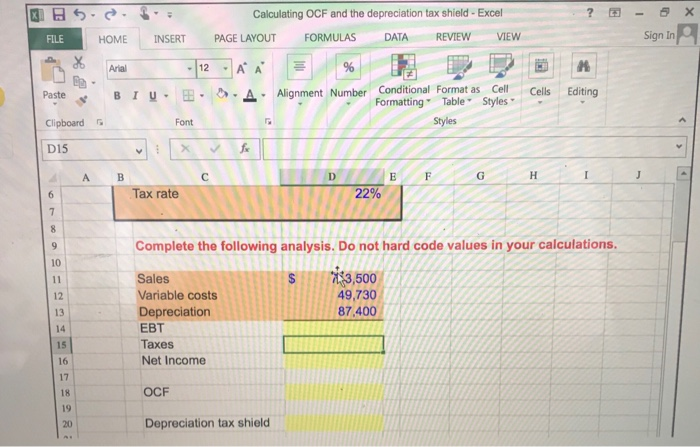

Solved Calculating Ocf And The Depreciation Tax Shield Excel Chegg Com

Tax Shield Formula How To Calculate Tax Shield With Example

Wacc Formula Excel Overview Calculation And Example

Effective Tax Rate Formula Calculator Excel Template

Interest Tax Shield Formula And Excel Calculator

Tax Shield Formula Step By Step Calculation With Examples

Tax Shield Formula Step By Step Calculation With Examples

Interest Tax Shield Formula And Excel Calculator

Complexities In Financial Modeling Excel Exposure

Solved Calculating Ocf And The Depreciation Tax Shield Excel Chegg Com

Cash Flow After Deprecition And Tax 2 Depreciation Tax Shield Youtube

Tax Shield Formula Step By Step Calculation With Examples